This is a general description, provided for an informative purpose, and does not have any legal force. In case of application you shall act in accordance with the regulatory enactment. In case of any questions, please, contact with the State Revenue Service of Latvia.

Arrangement of customs formalities in Latvia is performed only electronically. Customs declarations are submitted and signed in the SRS Electronic Declaration System, the user’s identifier and password of which shall be considered as substituting the signature.

Electronic customs declaration is submitted in the relevant functionality (such as, import declaration - in the Import functionality) of the Electronic Customs Data Processing System (ECDPS).

An entrepreneur may choose, whether to select the free Merchant’s user interface developed by SRS and offered to customers, or to use their own information systems for submission of data to customs, ensuring connection with the ECDPS.

Information on how to become a ECDPS user.

What is EXPORT

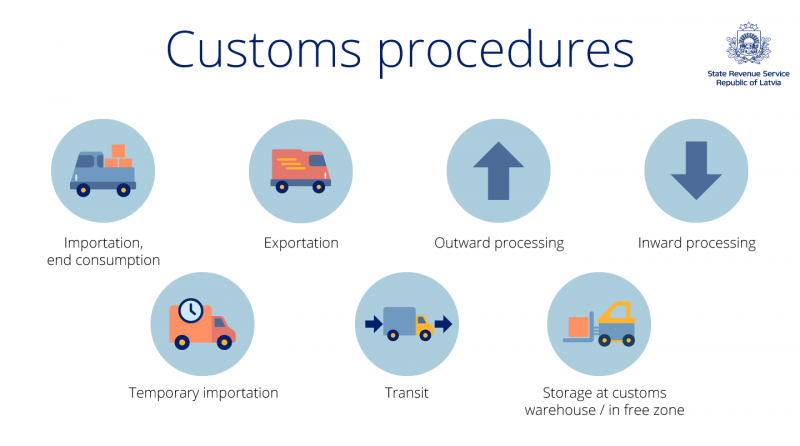

EXPORT (exportation) is the customs procedure, enabling to remove the EU goods from the customs territory of the EU, including application of exportation formalities, including trade policy measures.

What should be known when exporting goods

Trade policy measures to be applied to the relevant type of goods - restrictions, prohibitions, licenses, permits etc.

What is IMPORT

IMPORT (release of goods for free circulation) is the customs procedure, allocating to the non-EU goods the status of the EU goods and including application of importation formalities, including trade policy measures and collection of lawfully payable taxes.

What should be known when importing goods

Trade policy measures to be applied to the relevant type of goods (non-tariff measures) - restrictions, prohibitions, licences, permits etc. and payable taxes (tariff measures).

What taxes are to be paid for IMPORT of goods

Import duty (EU unified customs tariff) and payments equal to that (anti-dumping and compensation payments).

Value added tax (VAT) - 21 %, 12 %, 5 % or 0 %.

Excise duty for excise goods (tobacco products, tobacco leaves, liquids to be used for electronic cigarettes, alcoholic beverages, oil products, non-alcoholic beverages, coffee, natural gas).

Import or Release for free circulation

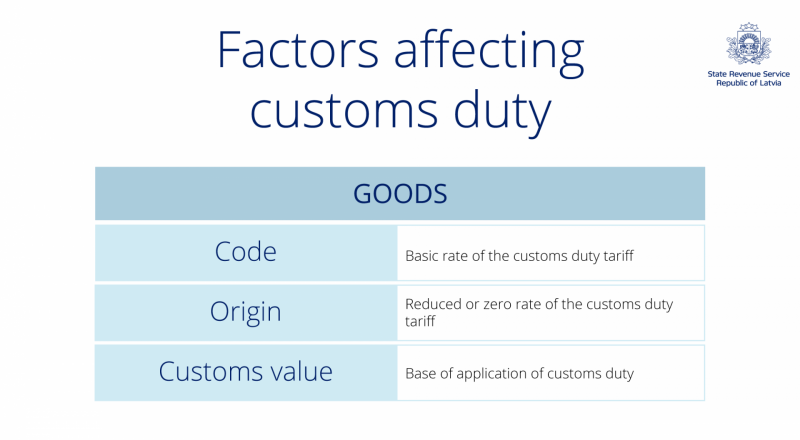

Determination of the CODE

In order to ensure legal certainty in transactions of import and export of goods, an economic operator may apply to the SRS National Customs Board and receive a Binding Tariff Information (BTI) - a decision of the customs authority regarding classification of the good, which is legally binding to all customs authorities of the EU and valid for 3 years from the date on which the decision takes effect.

Certification of ORIGIN

In order to facilitate formalities of arrangement of export procedure, an economic operator may apply to the SRS National Customs Board for the status of approved exporter to receive a customs authorisation number which shall appear on the origin declaration made out by the exporter itself.

Application of TARIFFS

In order to import the good with reduced import duty, a merchant may submit the preferential certification of origin or apply for tariff quotas (customs duty rebates determined by the EU, enabling to import the certain quantity of goods in the territory of the EU at the certain period of time by applying the reduced or zero customs duty rate) at the same time with the customs declaration.

VAT payment

In order to import goods with deferred VAT payment, a merchant may turn to the State Revenue Service and receive a PERMIT for application of the special VAT regime for product import transactions (postponement of payment of the VAT payment calculated in the import declaration until presentation thereof in the VAT declaration of the relevant period).

Latvian custom’s Integration Tariff Management System (ITMS) integrates the requirements of the EU and national regulatory enactments with regards to conditions for import and export of goods:

- tariff measures (tariff rates, tariff discounts, additional tax rates and calculation procedure);

- non-tariff measures (licences, permits, restrictions).