As of 28 December 2023, all enterprises can view their taxpayer rating in their Electronic Declaration System (EDS) profile. The State Revenue Service (SRS) invites all taxpayers to participate in an on-line seminar scheduled for 10 January at 10:00 on the SRS YouTube site.

The published taxpayer rating is for information purposes and is an important step to strengthen the awareness of fair business and to motivate and support entrepreneurs, thereby reducing the shadow economy. For companies with an A rating, SRS provides all the necessary support and a wide range of advantages. Control measures are planned only for companies with risks of violations.

Taxpayer rating indicators are designed as an explanatory road map for tax payment improvement. Indicators marked in green indicate flawless behaviour. Indicators coloured in yellow should be paid attention to and improvements should be planned. Those coloured in red are critical and must be improved.

Starting March 2024, the overall assessment of the rating - the letter rating for each specific company - will be available in the SRS public database. However, companies can already choose to voluntarily share their rating information with their cooperation partners and other interested parties. Also, companies can already start working on improving their indicators if necessary.

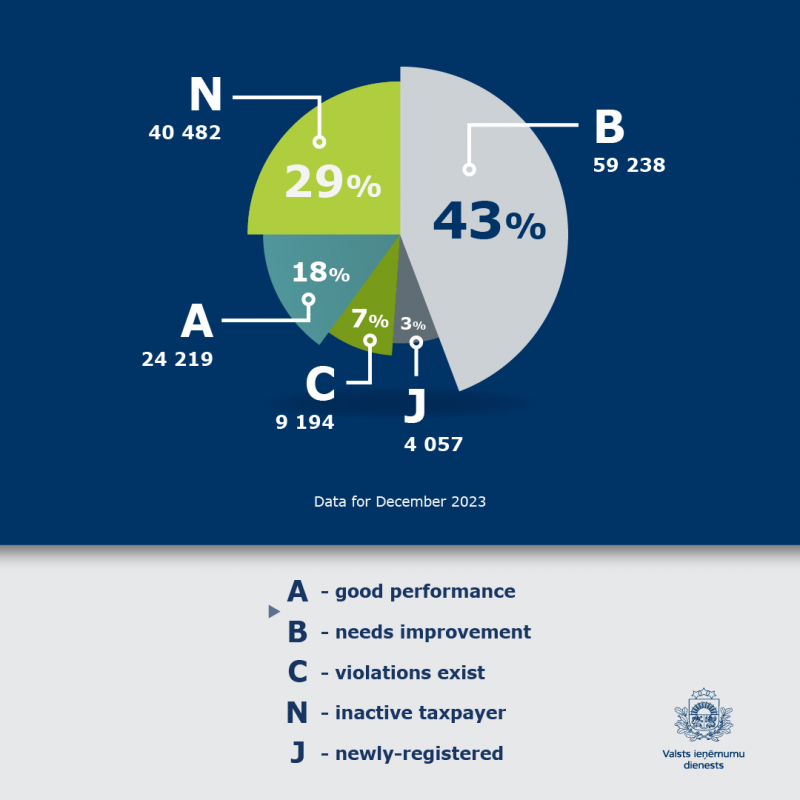

Companies have received one of five possible ratings:

A – timely and complete tax payment discipline and no significant risks. This company is a reliable taxpayer and can be a reliable cooperation partner.

B – generally fulfils its obligations to the state, but there is room for improvement - timely submission and more accurate preparation of declarations, declaring and paying all taxes on time. A level B company can be a business partner, but it is worth evaluating the terms of cooperation and whether the company has significant tax debts or not.

C – excluded from the VAT payer register for violations or SRS has suspended economic activity. The ability of such companies to fulfil their business obligations should be evaluated critically, and if the economic activity of the company has been suspended, transactions with it are prohibited by law.

N – inactive taxpayers who, according to information submitted by the company, do not conduct economic activity. When starting cooperation with such a company, it should be assumed that for at least 6 months there have been no declared transactions, and there are no employees to whom salaries have been paid.

J – registered within the last six months. It has not yet had time to prove itself, but any new beginning made in good faith is welcome.

The rating consists of six data sets – registration data, timely submission of declarations and reports, payment of taxes, penalties applied, remuneration (including comparison with others in that specific industry), and information that may indicate violations.

At the end of 2023, 18% of all Latvian companies were assessed at the A level (24,219 companies), 43% at B level (59,238), and 7% at C level (9194). Only 3% (4057) were newly established companies, but 29% (40,482) were inactive taxpayers.

SRS will answer questions about the rating system, as usual, in the "Correspondence with the SRS" section of EDS, and by phone at +371 67120022, created especially for this topic.